Traveling internationally from the Philippines is an exciting experience, but before you head to the airport, there’s one crucial detail every traveler must consider: the Philippine travel tax. Whether you’re a Filipino citizen, a permanent resident, or a long-staying foreigner, understanding how much travel tax Philippines charges—and who needs to pay it—can save you time, money, and hassle at the airport. This comprehensive guide explains the latest rates, exemptions, payment methods, and the role the travel tax plays in the country’s tourism landscape.

How Much Travel Tax Philippines—What Every Traveler Needs to Know

If you’re planning to fly out of the country, one of the most important questions you’ll need answered is: how much travel tax Philippines charges for international departures. This government-mandated fee applies to most Filipinos and certain foreign residents, and knowing the rules, rates, and exemptions can save you time and money at the airport. In this guide, we break down the latest travel tax rates, who must pay, who is exempt, and how to make your payment hassle-free.

What Is the Philippine Travel Tax?

The Philippine travel tax is a mandatory fee imposed by the government on individuals leaving the country for international destinations. Established under Presidential Decree No. 1183 and managed by the Tourism Infrastructure and Enterprise Zone Authority (TIEZA), the travel tax applies regardless of where your ticket was issued or purchased. This levy is separate from terminal fees and is a significant source of funding for tourism, education, and cultural programs in the Philippines.

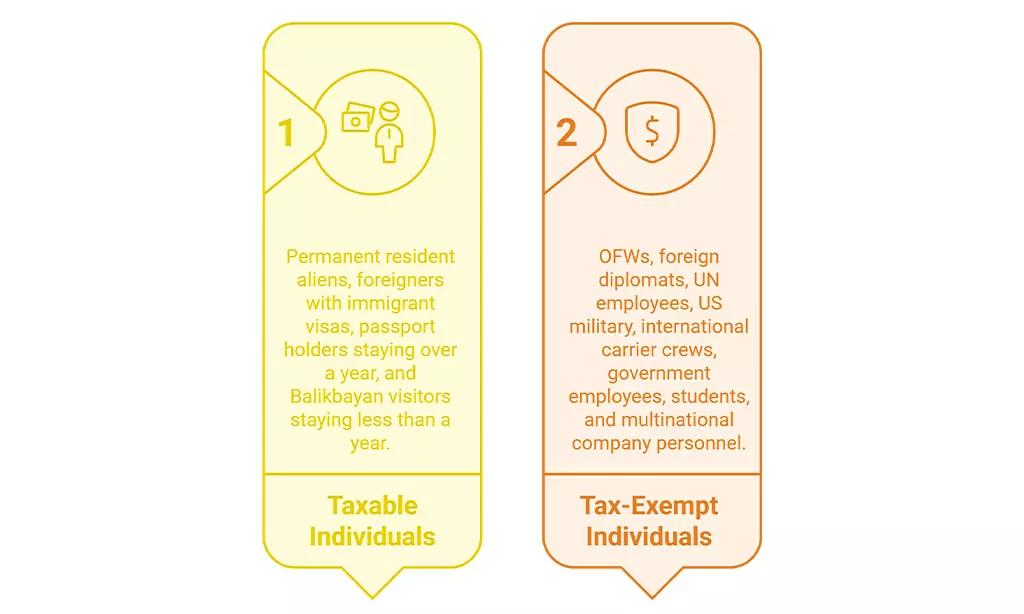

Who Needs to Pay the Travel Tax in the Philippines?

The travel tax is not universal—certain categories of travelers are required to pay, while others are exempt or eligible for reduced rates. Here’s a breakdown:

Required to Pay

- Filipino citizens traveling internationally

- Permanent resident aliens (foreigners with immigrant visas)

- Foreign passport holders who have stayed in the Philippines for more than one year

- Filipino citizens who are permanent residents abroad

- Balikbayan visitors who have stayed in the country for less than a year

Exempt from Paying

- Overseas Filipino Workers (OFWs) with valid documentation

- Foreign diplomatic representatives and certain foreign government officials

- United Nations employees

- US military personnel

- Members of international carrier crews

- Philippine government employees on official travel

- Students on scholarships

- Personnel of multinational companies

Foreign tourists visiting the Philippines for less than one year are exempt from paying the travel tax Philippines, but may still be subject to terminal fees upon departure.

How Much Travel Tax Philippines: Official Rates for 2025

The amount you pay depends on your ticket class and eligibility for reduced rates. The table below summarizes the current travel tax rates:

| Category | First Class Passage | Economy Class Passage |

| Full Travel Tax | PHP 2,700 | PHP 1,620 |

| Standard Reduced Travel Tax | PHP 1,350 | PHP 810 |

| Privileged Reduced Travel Tax (OFW Dep.) | PHP 400 | PHP 300 |

Full Travel Tax: Applies to most Filipino citizens and eligible foreign residents.- Standard Reduced Travel Tax: For certain minors, students, and senior citizens, subject to documentation.

- Privileged Reduced Travel Tax: For dependents of Overseas Filipino Workers (OFWs).

How and When to Pay the Travel Tax Philippines

Payment Channels

- Online: Through the TIEZA Online Travel Tax Services System (OTTSS), accessible via the official TIEZA website. Payment can be made using credit/debit cards, e-wallets, and online banking.

- At the Airport: TIEZA counters are available at major airports, including all NAIA terminals and select provincial airports.

- Through Select Airlines: Some airlines include the travel tax in the ticket price—always check when booking.

- Government Service Centers: Payment counters are available in select malls and government offices nationwide.

When to Pay

You must pay the travel tax before your flight. Paying online or in advance is recommended to avoid long queues and last-minute stress at the airport.

Travel Tax Philippines: Exemptions and How to Apply

If you believe you are exempt or eligible for a reduced rate, you must secure a Travel Tax Exemption Certificate from TIEZA. The process typically involves:

- Submitting required documents (e.g., Overseas Employment Certificate for OFWs, proof of age for minors/senior citizens, diplomatic credentials)

- Paying a PHP 200 processing fee

- Presenting your exemption certificate at the airport

Travel Tax vs. Terminal Fee: What’s the Difference?

It’s important not to confuse the travel tax with terminal or airport fees. Terminal fees are charged for the use of airport facilities and are often included in your airline ticket, especially for departures from major airports like Manila’s NAIA. The travel tax, however, is a separate government levy and must be paid by eligible travelers regardless of ticket purchase location.

Where Does the Travel Tax Go?

The travel tax Philippines is distributed to support several national initiatives:

- 50% to the Commission on Higher Education (CHED) for tourism-related educational programs

- 40% to TIEZA for tourism infrastructure and development projects

- 10% to the National Commission for Culture and the Arts (NCCA) for cultural programs

Paying the travel tax directly contributes to the country’s tourism growth, education, and cultural preservation.

Recent Developments and Statistics

Travel Tax Collection and Economic Impact

- In 2022, the Philippine government collected PHP 2.3 billion in travel tax, a significant rebound from pandemic lows (PHP 1.23 billion in 2020 and PHP 359 million in 2021).

- The country’s tourism sector hit a record high in 2024, with revenues reaching PHP 760.5 billion, marking a 9% year-on-year growth and exceeding pre-pandemic levels.

- Over 5.4 million foreign tourist arrivals were recorded in 2024, up 8.7% from the previous year, reflecting strong recovery and resilience in the tourism industry.

New Payment Systems

- TIEZA launched the Online Travel Tax Services System (OTTSS) in 2022, offering over 90,000 payment options nationwide and streamlining the payment process for travelers.

- The system has significantly reduced airport congestion and made outbound travel more seamless.

Upcoming Changes

- Terminal fees at NAIA are set to increase in September 2025: PHP 950 for international flights (up from PHP 550) and PHP 390 for domestic flights (up from PHP 200).

- The Philippines introduced a VAT refund policy for foreign tourists in 2025, allowing non-resident visitors to claim VAT refunds on purchases above PHP 3,000, further boosting tourism spending.

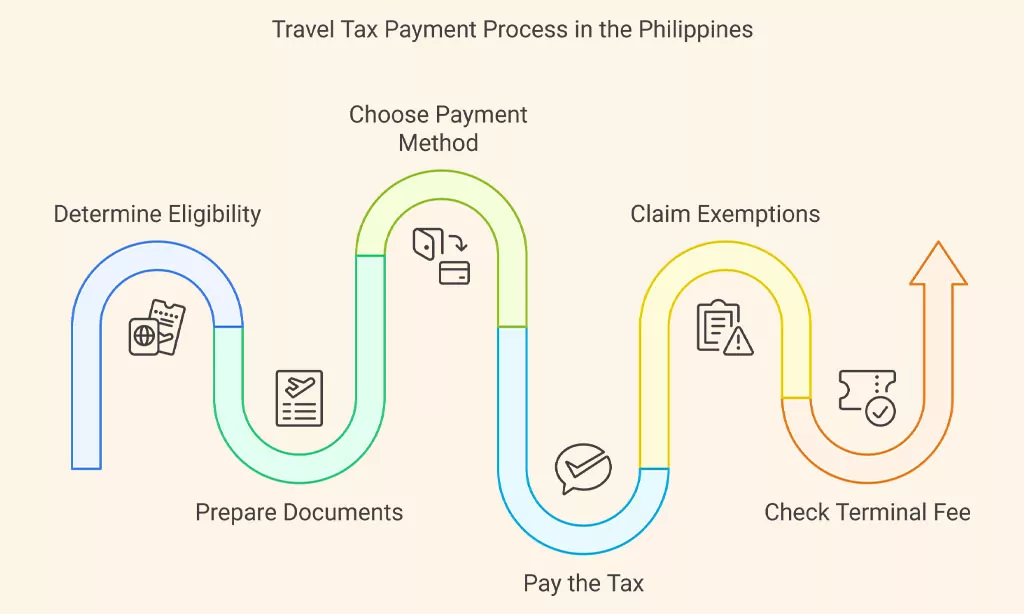

Step-by-Step Guide: How to Pay the Travel Tax Philippines

- Determine if you need to pay: Check your eligibility based on citizenship, residency, and length of stay.

- Prepare documents: Have your passport, airline ticket, and any supporting documents ready.

- Choose your payment method: Decide whether to pay online, at the airport, or through your airline.

- Pay the tax: Complete the payment and save your receipt.

- Claim exemptions/reductions (if applicable): Apply for a Travel Tax Exemption Certificate from TIEZA and present it at the airport.

- Check terminal fee status: Verify if your terminal fee is included in your ticket or needs to be paid separately.

Frequently Asked Questions (FAQs)

Do children need to pay the travel tax Philippines?

- Children under 2 years old are generally exempt. Minors (2–12 years old) and students may qualify for reduced rates with proper documentation.

Can I pay the travel tax Philippines online?

- Yes, the TIEZA Online Travel Tax Services System (OTTSS) allows you to pay online using various methods, making the process quick and convenient.

What if I forget to pay before arriving at the airport?

- You can still pay at TIEZA counters in the airport, but it’s best to pay in advance to avoid delays.

Are foreign tourists required to pay the travel tax Philippines?

- Foreign tourists staying less than one year are exempt. Those staying over a year or with certain residency statuses must pay.

What happens if I am exempt but paid the travel tax Philippines?

- You can apply for a refund through TIEZA, but this process may require additional documentation and time.

Quick Reference Table: Travel Tax Philippines 2025

| Traveler Category | Tax Amount (Economy) | Tax Amount (First Class) | Exempt? |

| Filipino Citizen | PHP 1,620 | PHP 2,700 | No |

| Permanent Resident Alien | PHP 1,620 | PHP 2,700 | No |

| Foreign Tourist (<1 year stay) | PHP 0 | PHP 0 | Yes |

| OFW | PHP 0 | PHP 0 | Yes |

| Dependent of OFW | PHP 300 | PHP 400 | Reduced Rate |

| Minor (2–12 years) | PHP 810 | PHP 1,350 | Reduced Rate |

| Diplomat/UN Employee | PHP 0 | PHP 0 | Yes |

Takeaways

Understanding how much travel tax Philippines charges—and who is required to pay—is essential for a smooth international travel experience. The standard rates are PHP 1,620 for economy and PHP 2,700 for first class, with reductions and exemptions available for specific groups. Always check your eligibility, pay in advance if possible, and keep your receipts handy. By complying with travel tax requirements, you’re not only ensuring hassle-free travel but also contributing to the Philippines’ tourism, education, and cultural development.

For the most up-to-date information and online payment, visit the official TIEZA website or consult your airline before your trip. Safe travels!