Are travel expenses tax deductible? If you travel for work, this question might pop up every tax season. Business owners and self-employed pros often struggle to figure out which travel costs they can claim on their taxes.

From plane tickets to hotel stays, the rules can leave you scratching your head.

The IRS allows you to deduct many business travel expenses on your tax return. You can write off transportation, lodging, and even half of your business meals. But there’s a catch – these costs must be both ordinary and necessary for your work.

This guide breaks down every detail about travel expense deductions. We’ll show you what you can claim, how to track your costs, and ways to maximize your tax savings. Ready to cut your tax bill?

Key Takeaways

- Business travelers can deduct 100% of transportation costs and lodging, plus 50% of meal expenses in 2024 if they meet IRS rules.

- To qualify for tax deductions, trips must be at least 50 miles from your tax home and require an overnight stay for clear business purposes.

- Personal expenses, luxury upgrades, and travel costs for family members don’t count as business deductions unless they work as employees.

- Keep detailed records of all receipts, business purposes, and dates. The IRS needs proof that expenses are ordinary and necessary for your work.

- Most W-2 employees can’t claim travel deductions after the Tax Cuts and Jobs Act, but self-employed people and business owners still can.

What Qualifies as a Business Trip for Tax Deductions?

Business trips need a clear money-making purpose to qualify for tax write-offs. You must travel away from your tax home, which means staying overnight at least 50 miles from your main workplace.

Definition of a business trip

A business trip happens when you travel away from your tax home for work purposes. Your tax home means the city or area where you normally work, not where you live. The IRS says these trips must be both ordinary and necessary for your job or company.

You’ll need to stay away overnight or long enough to need rest during your work duties.

The IRS sets clear rules about what counts as a proper business trip in 2024. You can claim deductions if you’re self-employed or own a company. Your travel must last less than one year to qualify as temporary work assignment.

The purpose of your trip needs to focus on tasks like meeting clients, attending conferences, or completing job duties at another location. Simple daily commutes to your regular workplace don’t count as business travel.

Ordinary vs. necessary expenses

The IRS sets clear rules about ordinary and necessary business expenses for tax deductions. Ordinary expenses include common costs that most business travelers face, like hotel stays and airfare.

Necessary expenses must help your business run and make money. These costs need to match your business size and type. For example, a small business owner might need basic hotel rooms for client meetings, while luxury suites wouldn’t count as necessary.

Tax laws require proof that your travel expenses directly tie to making income. Your receipts must show clear business purposes, like meeting dates and client names. The IRS allows deductions for standard transportation costs and regular meals during business trips.

You’ll need to track every expense with proper documentation to claim these tax benefits. Next, let’s explore which specific travel expenses qualify for tax deductions.

Are Travel Expenses Tax Deductible?

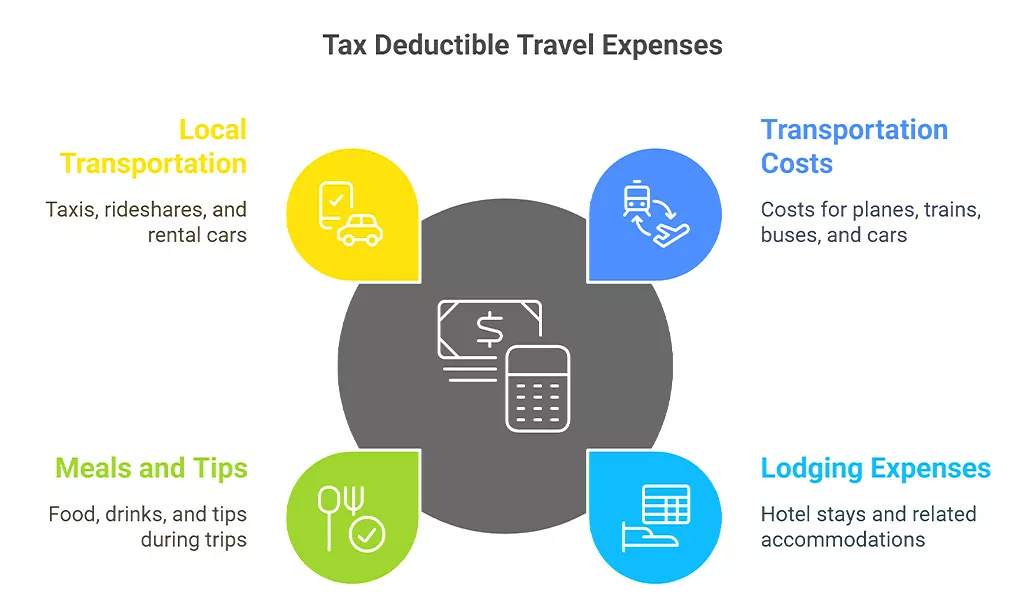

Business travelers can claim many costs on their tax returns. From plane tickets to hotel stays, the IRS allows write-offs that match your work needs.

Transportation costs

The IRS lets you deduct 100% of your travel costs to and from your business location. These costs cover plane tickets, train fares, bus rides, and even car expenses for work trips away from your tax home.

Your travel must meet the IRS rules for “ordinary and necessary” expenses to qualify. You’ll need to save all tickets, receipts, and booking confirmations as proof of your spending.

Smart travelers track their transportation expenses with care. Self-employed people can claim mileage rates, parking fees, and toll charges on their tax returns. For 2024, you must keep exact records of each trip’s purpose and distance.

The standard mileage rate helps figure out car-related deductions. Taxi fares, rideshares, and rental cars also count as valid business transport costs if they’re needed for work duties.

Lodging expenses

Moving beyond transportation costs, hotel stays make up a big part of business travel expenses. Your room charges count as tax deductions if you need to stay overnight for work. Business travelers can claim 100% of their basic lodging costs on their tax returns, including standard hotel rooms and necessary amenities.

Hotels must meet IRS rules for business expense claims. You’ll need to keep all receipts and proof that your stay relates to work activities. Room service and extra charges like spa treatments don’t qualify as business costs.

Smart travelers stick to reasonable accommodations and save their hotel bills to back up their deductions. Self-employed people should track these expenses separately from personal stays to make tax filing easier.

Meals and tips

Business travelers can deduct 50% of their meal costs during trips in 2024. This rule applies to food and drinks at restaurants, cafes, or room service. Tips for servers, hotel staff, and taxi drivers count as deductible expenses too.

You’ll need to save your receipts and note the business purpose of each meal.

The IRS accepts both actual expenses and per diem rates for meal deductions. Per diem rates make tracking easier because you don’t need receipts for meals. Your location determines the daily meal allowance rate.

Business owners must keep clear records of who attended meals and what business topics they discussed. Next, let’s explore the fees you might pay for getting around during your business trips.

Fees for getting around (e.g., taxis, rideshares, rental cars)

Local transportation costs during business trips can save you money at tax time. Taxi fares, rideshare services, and car rentals count as tax deductions if you use them for work purposes.

The IRS allows you to claim these expenses as long as they’re ordinary and necessary for your job. You’ll need to keep receipts and track each ride or rental separately from personal trips.

Public transportation, parking fees, and tolls also qualify as write-offs during business travel. Self-employed people can claim these costs on Schedule C of Form 1040. The key lies in proper documentation – save those receipts, note the business purpose, and record dates of each trip.

Smart record-keeping now means fewer headaches during tax season.

What Travel Expenses Are Not Tax Deductible?

You’ll need to know which travel costs the IRS won’t accept as tax write-offs, so let’s explore the expenses that won’t make the cut on your tax return.

Personal travel expenses

Personal trips mixed with business travel don’t qualify for tax deductions. The IRS draws a clear line between business and pleasure activities during your travels. Sightseeing tours, spa visits, or extra days added to your trip for vacation fall under personal expenses.

These costs must stay separate from your business expense records.

Taking family members along on business trips creates extra expenses that aren’t tax-deductible. Your spouse’s plane ticket, their meals, or their share of the hotel room can’t go on your tax return.

The IRS only accepts costs tied to the business portion of your journey. A good rule: if the expense doesn’t help your work goals, it stays off your tax forms.

Expenses for friends or family members

Business trips need clear lines between work and fun. The IRS won’t let you claim tax deductions for your spouse’s travel costs unless they work as your employee. Your kids’ plane tickets and hotel stays don’t count as business expenses either.

The tax rules stay firm on this: family fun time isn’t part of your business write-offs.

The IRS focuses on actual business-related costs for tax deductions. You can’t mix family vacation expenses with your business travel deductions. For example, if you book a bigger hotel room for your family, you can only deduct the cost of a standard single room.

The same goes for rental cars – if you get a larger vehicle to fit the whole family, you’ll need to calculate what a basic business-sized car would cost. These rules help keep your tax return clean and audit-proof.

Luxury upgrades not related to business

Just like personal expenses for family members, luxury upgrades fall into a clear no-deduct zone. The IRS draws a firm line between basic travel needs and fancy extras that don’t help your business goals.

First-class airline tickets, luxury car rentals, and fancy hotel suites don’t qualify as ordinary and necessary expenses for tax purposes.

You must stick to standard business-class travel options to claim your deductions. For example, if you book a basic hotel room at $200 per night but upgrade to a suite for $500, you can only deduct the $200 base rate on your tax return.

The same rules apply to transportation costs – the IRS allows deductions for regular car rentals but not for premium vehicles chosen purely for comfort or style. Keep your receipts simple and focused on what you need to do business, not what makes the trip more enjoyable.

How to Write Off Travel Expenses on Your Taxes

Writing off travel expenses needs a clear plan and solid proof. You’ll need to track every receipt and record each business trip detail with the IRS’s rules in mind.

Confirm your eligibility

Your tax home plays a big role in claiming travel deductions. Self-employed people and business owners can deduct travel costs if they meet IRS rules. The expenses must be both ordinary and needed for your work.

Most W-2 employees can’t claim these write-offs since the Tax Cuts and Jobs Act changed the rules.

Business trips must take you away from your regular work area to qualify. The IRS says your work assignment can’t last more than one year at the new spot. You’ll need proof that shows why each trip was needed for business.

Keep records of your plane tickets, hotel bills, and meal costs to back up your claims. Smart record-keeping now saves headaches during tax season.

Save all receipts and documentation

Keeping receipts and records for business travel isn’t just smart – it’s a must for tax purposes. The IRS needs proof of every expense you claim on your tax return. Store all receipts, bills, and credit card statements in a safe spot.

Digital copies work great too – snap photos of paper receipts or use expense tracking apps to stay organized. Business owners should track transportation costs, hotel bills, meal expenses, and baggage fees separately.

Good record-keeping starts with marking each receipt with the business purpose right away. Write down who you met with and what you discussed for business meals. Keep train tickets, car rental agreements, and parking stubs in order by date.

Smart documentation helps protect you during a tax audit and makes tax preparation easier. A certified public accountant can guide you through proper expense tracking methods. Moving on to international business travel rules, these guidelines become even more critical.

Itemize your expenses correctly

Proper itemization of business travel expenses starts with clear records. You’ll need to sort each cost into specific groups like transportation, lodging, and meals. Your tax return must show exact amounts for plane tickets, hotel stays, and car rentals.

The IRS allows you to claim 50% of your business meal costs in 2024, so track those dinner receipts carefully.

Business travelers must separate personal costs from work expenses on mixed-purpose trips. List each business expense on Schedule C if you’re self-employed, or Schedule A for W2 employees.

Your records should include dates, locations, and business purposes for each expense. Smart record-keeping helps protect your deductions during tax audits. Tools like TurboTax or QuickBooks can help organize these expenses into the right categories for tax filing.

Rules for International Business Travel

International business trips need special tax rules that differ from domestic travel. The IRS treats foreign travel expenses as tax-deductible if you can prove the trip’s main purpose was for business and you followed proper documentation steps.

Travel solely for business purposes

Business trips need clear proof that you traveled only for work. The IRS allows you to claim 100% of your transportation costs to your business destination, including airplane travel, train tickets, and bus fares.

Your tax home serves as the starting point for these deductions, and you must keep detailed records of all business-related expenses.

Tax deductions apply to necessary business expenses during your work trips. You can write off lodging expenses, parking fees, and half of your business-related meals on your tax return.

Self-employed people and business owners must save receipts and track every cost. A certified public accountant can help sort through complex rules about mixed personal and business travel expenses.

Mixed business and personal travel guidelines

Mixing personal fun with work trips needs clear rules for tax deductions. You must split your expenses between business and personal activities to claim the right amount. The IRS allows you to deduct 100% of transportation costs to and from your destination if the primary reason for travel relates to work.

Your lodging expenses qualify only for the days you conduct business activities. For example, if you spend five days in New York with three days of client meetings, you can only deduct three nights of hotel stays.

Tax laws get specific about meal deductions during mixed-purpose trips. Self-employed travelers can claim 50% of their food costs, but only for days filled with business tasks. Smart record-keeping makes a huge difference – save those receipts and note which expenses link to work versus pleasure.

Your tax home location matters too, as temporary work assignments under one year follow different rules than regular business travel. A detailed travel log helps prove your case if the IRS asks questions about your deductions.

Many travelers use apps or digital tools to track expenses and sort them by purpose.

Calculating Business Travel Expenses

Money matters get tricky when mixing business with pleasure on your trips. You’ll need a solid system to track which days count for tax write-offs and which don’t – we’ll show you the exact math that keeps the IRS happy.

Trips with no personal days

Business trips without personal days offer the best tax benefits. The IRS allows you to deduct 100% of your transportation costs to and from your business destination. Your lodging expenses, taxi fares, and baggage fees qualify as full deductions too.

Self-employed travelers can claim 50% of their business meal costs in 2024.

Clear records make tax time easier. Keep all receipts for airplane tickets, hotel stays, and car rentals in one place. Your documentation needs to show the business purpose of each expense.

A tax preparer can help sort through complex deductions and maximize your tax refund. Simple organization now saves headaches during tax season.

Trips with personal days included

Unlike trips focused only on work, mixing personal days with business travel needs careful math. The IRS allows tax deductions for the business portion of your trip, but you must split up the costs.

Your transportation expenses to and from your business destination stay 100% deductible, even if you add personal days.

Your lodging and meal costs need a fair split based on business versus personal days. For example, if you spend five days in New York City with three days for work and two for fun, you can claim 60% of your hotel costs as a business expense.

The IRS expects clear records showing which days focused on work activities. Keep your receipts organized by date, and mark each expense as either business or personal on your tax return.

A daily log of your activities helps prove the business nature of your claimed expenses.

Tips for Avoiding Common Mistakes

Small mistakes in your tax records can lead to big headaches during an audit. A solid record-keeping system and proper documentation of business travel expenses will save you time and money during tax season.

Keeping accurate records

Good record-keeping saves you money during tax season. You must save all receipts, bills, and proof of payment for your business trips. The IRS needs clear proof of your travel costs before they allow tax deductions.

Store digital copies of your documents in cloud storage or apps like QuickBooks or TurboTax. Paper receipts fade over time, so snap photos right away.

Your records need to show the business reason for each expense. Write notes on receipts about who you met and what you discussed. Keep a daily log of your business activities while traveling.

Smart documentation helps protect your deductions if the IRS asks questions. The tax rules say you must track dates, amounts, locations, and business purposes for every expense you want to deduct.

Filing Form 8275 to avoid penalties

Form 8275 serves as your safety net against IRS penalties. This special tax form lets you explain any unclear positions on your tax return, especially for business travel deductions.

Filing this form shows the IRS you’re being open about your tax choices, which can protect you from costly penalties. You’ll need to list each expense and explain why you think it qualifies as a business deduction.

The IRS looks closely at travel expenses that seem unusual or large. Smart taxpayers fill out Form 8275 to back up their claims with solid proof. The form needs clear details about your business trips, including dates, locations, and business purposes.

A tax professional can guide you through proper documentation and help you avoid common filing mistakes. Let’s explore how working with a qualified tax expert can make your business travel deductions smoother.

Getting Professional Tax Support

A tax expert can spot hidden deductions you might miss and help you claim more money back. Many business owners save thousands of dollars each year by working with CPAs who know all the latest IRS rules about travel expenses.

Benefits of working with a tax professional

Tax professionals bring expert knowledge to handle complex business travel deductions. A certified public accountant (CPA) stays current with IRS guidelines and knows the exact rules for deducting travel expenses in 2024.

These experts help you claim the right deductions, from the 50% meal allowance to transportation costs. They spot opportunities you might miss, such as deducting baggage fees or business calls during your trips.

Working with tax experts saves time and reduces stress during tax season. They know which records you need and help organize your receipts for both domestic and international business travel.

Your CPA can explain tricky rules about temporary work assignments lasting under one year. They also protect you from costly mistakes by checking if your expenses count as ordinary and necessary for your business.

Most importantly, they stand by your side if the IRS questions your travel deductions during a tax audit.

Tools and resources for accurate filing

Beyond expert guidance, several handy tools make tax filing easier for business travelers. Popular software like TurboTax and Quicken helps track expenses and creates clear records for your tax return.

These programs connect straight to your debit card and bank accounts to sort business costs from personal spending.

Simple mobile apps let you snap photos of receipts right after meals or hotel stays. The IRS accepts digital copies of these records, which makes filing much simpler. Many apps also track mileage automatically through your phone’s GPS.

This feature proves helpful since the IRS allows standard mileage rate deductions for business car travel. The right tools paired with solid record-keeping will support your travel expense claims during tax season.

Takeaways

Business travel tax deductions can save you serious money on your tax return. Smart record-keeping makes claiming these deductions much easier. Keep all your receipts, track your expenses, and stay within IRS rules to maximize your savings.

A tax professional can guide you through complex situations and help you avoid costly mistakes. Your careful planning today leads to better tax benefits tomorrow.

For more insights on blending business with leisure travel, check out our article on why you should consider Iceland for your next business trip.

FAQs

1. What travel expenses can I deduct on my tax return?

You can deduct ordinary and necessary expenses like lodging expenses, transportation costs, and business-related meals. This includes airplane travel, train tickets, bus travel, car rentals, and taxi fares.

2. Do I need proof to claim business travel expenses?

Yes! Keep all receipts and business expense documentation to protect yourself during a tax audit. Smart business owners track every payment method used for transportation expenses, hotel expenses, and baggage fees.

3. Can self-employed people claim travel deductions?

Self-employed individuals can claim unreimbursed travel expenses on Schedule C of their individual income tax return.

4. What’s the deal with meal deductions during business trips?

The IRS allows you to use the standard meal allowance for food costs while traveling. Tips for services and incidental expenses are also tax write-offs.

5. How do I figure out my tax home for travel deductions?

Your tax home is your regular work location, not where you live. This matters when claiming deductions for temporary work assignments away from your main business destination.

6. What about shipping costs during business travel?

The IRS lets you deduct shipping of baggage and display material when they’re needed for your business purpose. Remember to save those receipts for your CPA!